Gold and silver have always been valuable, not just for their beauty but as assets that hold real financial worth. Whether you have old jewelry, coins, or bullion, knowing how these metals are priced can make a huge difference in what you get when you sell. Unlike everyday goods, their prices change constantly, influenced by global markets, investor behavior, and economic trends. If you’re looking to sell, here’s what you should know to get the best value.

Understanding the Spot Price – The Foundation of Gold & Silver Pricing

The first thing to grasp is the spot price—this is the live market price of gold or silver per ounce. It fluctuates based on trading activity in global commodity markets, especially the London Bullion Market and the New York COMEX exchange.

What Affects Spot Prices?

- Supply & Demand – When more people want gold and silver (especially during economic downturns), prices rise.

- Economic Conditions – Inflation, interest rates, and currency shifts all influence pricing.

- Investor Sentiment – Many investors see gold and silver as a safe haven. When the stock market struggles, they turn to precious metals, which pushes prices up.

- Mining & Production Costs – The cost of extracting and refining these metals also plays a role.

Spot prices update by the second, meaning the value of your gold or silver can shift even within a single day.

Purity & Weight – Why They Matter in Pricing

Gold and silver aren’t always sold in pure form. Jewelry, coins, and bullion come in various purity levels, and that directly affects their resale value.

Gold Purity Levels

- 24K (99.9% pure) – Typically used in bullion and high-value investment pieces.

- 22K (91.6% pure) – Found in fine jewelry, especially in Asian and Middle Eastern markets.

- 18K (75% pure), 14K (58.3% pure), 10K (41.7% pure) – Common in everyday jewelry.

Since lower-karat gold is mixed with other metals, its value is lower than pure gold. Buyers assess your gold’s worth based on its actual gold content, not its total weight.

Silver Purity Levels

- .999 Fine Silver (99.9% pure) – Used in investment-grade bullion.

- Sterling Silver (92.5% pure) – Common in jewelry and antique silverware.

- Coin Silver (90% pure) – Found in older silver coins.

Knowing the purity of your gold or silver before selling can help you set realistic expectations about its value.

Market Trends – When’s the Right Time to Sell?

Just like stocks, gold and silver prices go through ups and downs. Selling at the right time can mean a much better payout.

Good Times to Sell:

- Gold & Silver Prices Are Peaking – Looking at historical price trends can help you spot when prices are at a high.

- Economic Uncertainty Is Increasing Demand – In times of recession or high inflation, more investors buy gold and silver, pushing prices up.

- A Weaker U.S. Dollar – When the dollar loses value, gold prices tend to rise.

Keeping up with financial news and market trends will give you an edge in deciding when to cash in.

How Buyers Calculate What They’ll Pay

Buyers don’t just hand you the spot price—there are other factors at play. Here’s what they consider:

- Current Spot Price – The base value of your gold or silver.

- Weight & Purity – How much actual gold or silver your item contains.

- Buyer’s Fee or Commission – Most buyers take a small percentage as profit.

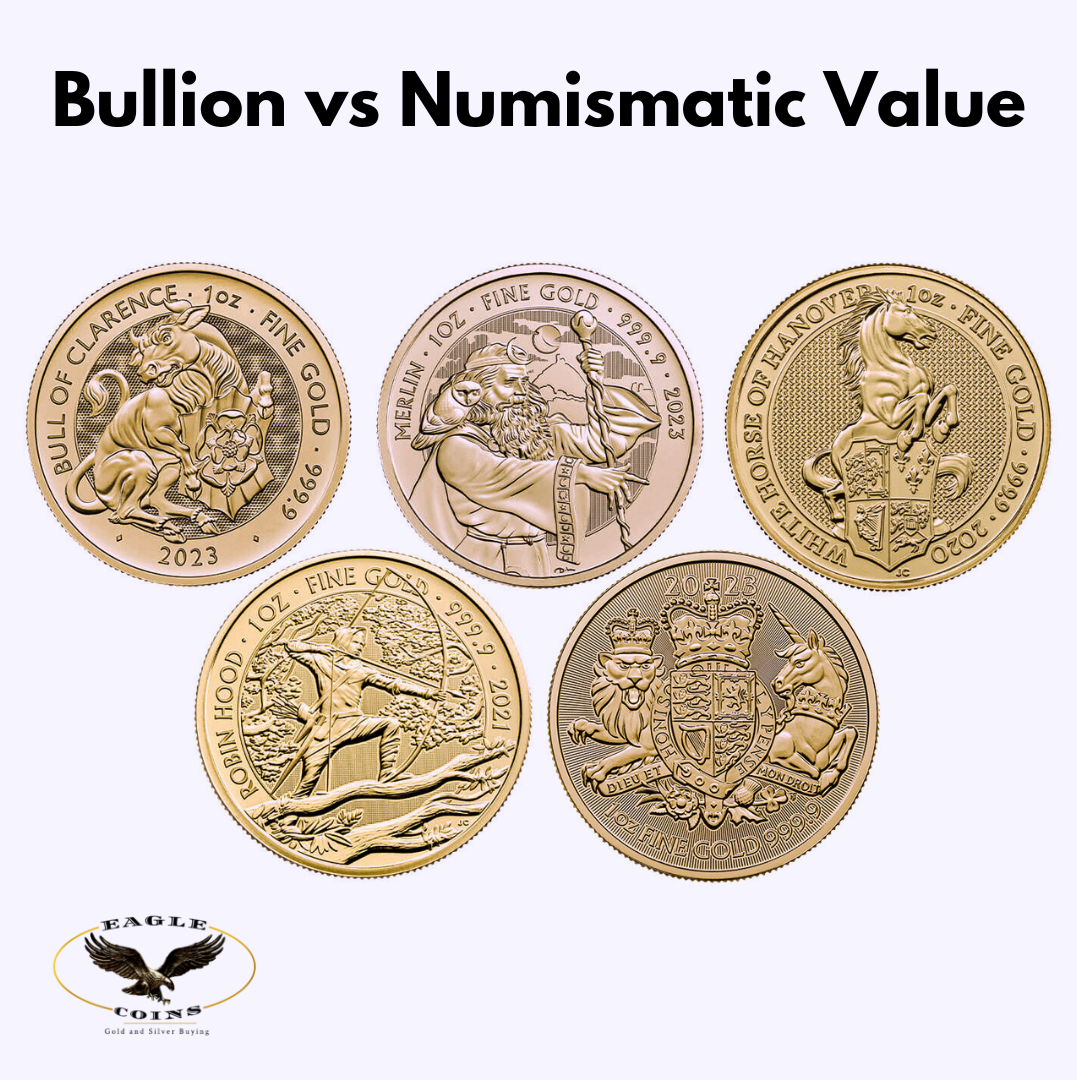

- Rarity & Collectibility – Some coins and antique pieces have extra value beyond their metal content.

- Condition – Worn or damaged pieces may sell for slightly less.

It’s always a good idea to compare offers from multiple buyers to ensure you get a fair deal.

Where to Sell for the Best Price

Choosing the right buyer is just as important as timing your sale. Here are your best options:

- Local Coin & Bullion Dealers – Typically offer competitive rates based on live market prices.

- Gold & Silver Exchanges – Some cities have dedicated exchanges that provide high payouts.

- Online Precious Metal Buyers – Reputable platforms like APMEX and JM Bullion offer mail-in services and fair rates.

- Pawn Shops & Jewelry Stores – Good for quick cash, but they often pay less than market value.

- Auction Houses & Collectors – Ideal for rare coins and antique pieces that may have value beyond their metal content.

Final Thoughts

Selling gold and silver can be a smart financial move if you understand the pricing process. By knowing the spot price, understanding purity levels, and timing your sale wisely, you can maximize your return. And when you’re ready to sell, working with a trusted buyer makes all the difference.

At Eagle Coins Gold and Silver Buying, we provide expert evaluations, competitive pricing, and secure transactions, ensuring you get top dollar for your gold and silver. Whether you’re selling jewelry, coins, or bullion, we’re here to help you make the most of your assets.

Don’t settle for less—sell with confidence and get the best value for your precious metals today!